The larger a company’s fleet, the more solutions are needed for its management – especially if the fleet includes not only light vehicles or trucks, but also industry-specific machinery.

One such industry is forestry, which encompasses much more than just cutting trees. It also includes forest planting, care, maintenance, harvesting, and soil renewal – all these stages of forestry require different techniques and equipment.

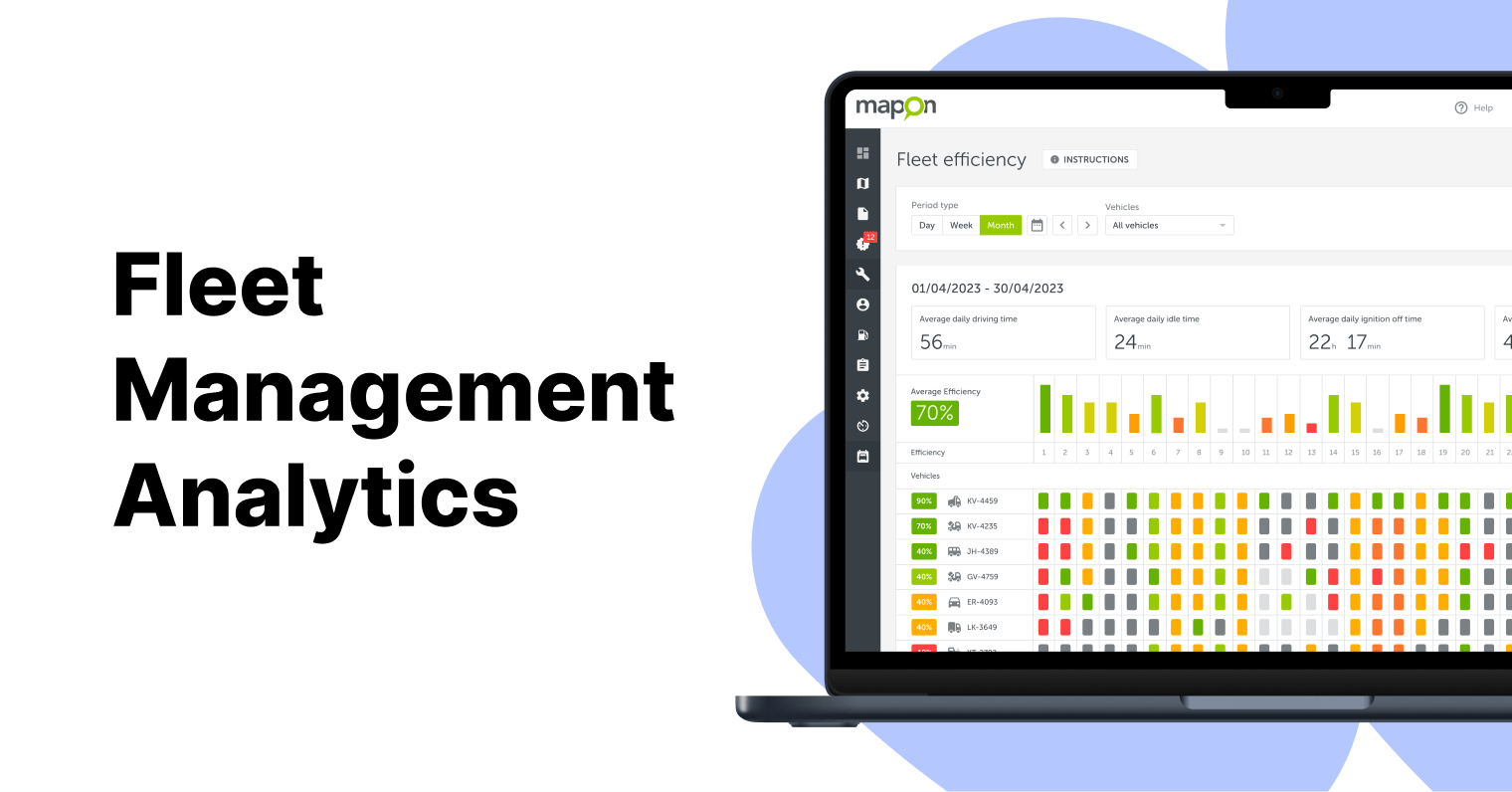

The forestry company R GRUPA currently has more than 150 equipment units, most of which are connected to the Mapon platform. What made the company choose Mapon as its fleet management provider? What solutions are used for different purposes, and how can the information obtained from the Mapon platform be used for more efficient work?

We sat down with Krišjānis Caune, the Head of Marketing and Communications at R GRUPA, to find answers to all these questions.

Mapon Has the Most Comprehensive Solutions for Large Companies

Krišjānis Caune, Head of Marketing and Communicationsat R GRUPA, talks with Mapon representatives

R GRUPA’s fleet includes light vehicles used by administrative employees and forestry foremen, freight transport, logging machinery, as well as specific equipment, such as wood chippers. Each unit requires its own approach to data acquisition and analysis.

“We are a manufacturing company and productivity is very important to us. To be able to improve it, we analyse a huge amount of key information, including fleet data. When we realised that the company needed to improve in this area, we did market research to understand what solution would best suit our needs. Mapon won because it offers the most versatile solutions that work for all our vehicle and equipment categories,” – the R GRUPA representative explains the decision to choose Mapon.

6 Mapon Solutions for R GRUPA’s Fleet

R GRUPA uses the following Mapon solutions for fleet management:

GPS tracking for cars, trucks, and wood chippers

Fuel rods for trucks

Remote tachograph data download

CAN data reading for forest machinery

Tachogram – the tachograph data platform

A camera system for the wood chipper

Don’t Just Get the Data – Use It Properly

Krišjānis Caune explains that having the tracking solutions is only part of the job. The most important thing is to understand what to do with the obtained data. For example, it is crucial to choose the most suitable route for cargo transport. Different data is used for light vehicles that drive over a wider area or for harvesting and logging machinery that works more locally, in specific regions.

The same applies to fuel monitoring data. Differences in consumption between newer and older machinery are used in productivity calculations and job planning.

See Deviations From the Norm Immediately

Implementing fuel monitoring solutions can quickly and significantly reduce consumption by detecting theft or an inefficient vehicle. R GRUPA, however, is more focused on regular, long-term monitoring, which lets them keep track of accurate average indicators. The company has an innovative approach to fuel consumption management, as well as a positive employee culture, so fuel monitoring is mostly used to notice deviations from normal consumption and understand how to improve the situation.

Fleet Management is Similar to Aviation

An R GRUPA employee uses the Mapon fleet management platform

When it comes to fleet management, R GRUPA takes note from aviation, where safety and flawless work with data is vital. Krišjānis Caune explains that the company backs up data records – both fuel management and remote tachograph download solutions serve this purpose. They help to ensure security and accuracy by minimising human error.

Management Solutions Also Affect Productivity

R GRUPA’s management is confident that thorough compliance with tachograph rules is a key productivity indicator for every driver. A rested person is much more productive while overworking reduces it drastically. A driver’s productivity on the road is closely related to safety – that’s why R GRUPA emphasises that it monitors tachograph data primarily to make sure that no driver has driven too much. The solution also helps to discover which drivers are currently under-worked and can be assigned extra trips.

As it’s essential to comply with the legal requirements, R GRUPA has also set tachograph alerts for calibration and data download deadlines.

Planning Routes – Easier With Mapon

R GRUPA currently has more than 150 equipment units, most of which are connected to the Mapon platform

Krišjānis Caune names the ability to analyse daily activities as one of the biggest advantages of using Mapon solutions.

“We analyse not only to control but to become more aware of what we’re capable of”.

Each fleet management solution contributes to a total result daily. Route planning is one obvious example – what once looked like a theoretical instruction to get from A to B is now a data-driven decision. The company carries out detailed route planning, communicates with drivers, and develops the optimal route. Route maps are also produced and can be used by anyone who drives the company’s vehicles.

R GRUPA is aware that a route that looks good on paper may not always be drivable, for example, due to weather conditions. To make the most of drivers’ time, colleagues in the logistics department and drivers need to maintain good communication to make adjustments. It also positively impacts drivers’ pay as no hours are wasted.

“Mapon saves the most precious thing we have – time. And if we can save time, then we can figure out what to do with it – the main thing is to actually free up that time”.

What Do Drivers Think About Mapon Solutions?

R GRUPA tracks a variety of vehicles, including trucks

Fleet management starts in the vehicle and continues in the office – and both stages are closely related, so all employees must understand how and why the company uses specific telematics solutions.

R GRUPA points out that while drivers haven’t extensively commented on Mapon solutions, it does not necessarily mean they do not understand or need them. On the contrary, one gets used to good things very quickly. If you don’t think too much about using something, it means that you have gotten used to the solution and its positive impact on your daily life. In work and life, we are much more likely to discuss the things that get in the way rather than highlight the good aspects – the same applies to fleet management.

Krišjānis Caune compares the relationship between vehicle drivers and fleet managers to professional sports:

“We can compare drivers to professional athletes, and managers to coaches. We ask drivers to remember one thing – to insert the card in the tachograph when they get into the vehicle. Afterwards, we can work with the drivers to see what has been done during the day and how to do it better. We are like coaches talking to athletes about ways to improve their performance.”

R GRUPA also emphasises that drivers are not obliged to analyse the data of the Mapon platform – this is the administration’s task.

Mapon Solutions – Not Only for the Transport Department

Fleet management solutions provide a wealth of information. That’s why the Mapon platform is used by different departments to analyse all the data and provide actionable insights.

At R GRUPA, the greatest demand for Mapon solutions is in the transport department. The next structure that also frequently uses these solutions is the logistics department. The harvesting and logging department also benefits from Mapon, as they too have to operate with movement or transport.

In general, all R GRUPA employees who use fleet units tend to look at the data provided by Mapon to get reliable reports on driving routes and timelines. This information is also important for accounting, which uses Mapon solutions to make sure that every litre of fuel is accounted for correctly.

Innovation Is Easier with Mapon

R GRUPA implements innovations and follows sustainability trends

The COVID-19 pandemic has prompted many companies to digitise processes and provide reliable, remote access to documents, meetings, and equipment monitoring. The latter is especially relevant for companies that use equipment in remote locations, including outside their base country.

To monitor their wood chipping equipment, which R GRUPA calls a real mobile factory, the company decided to run an experiment – they had several cameras installed on one machine. Thanks to those cameras, it’s now possible to connect to the vehicle at any time and check the safety and real-time productivity remotely.

Other sophisticated machinery is also connected to Mapon solutions – for example, fuel monitoring with CAN data is very useful for forest equipment, which R GRUPA uses extensively in its daily work. Krišjānis Caune even compares such technology to spaceships – while previously such complicated devices could only be seen on television, now almost equally advanced equipment is at work right here in our forests.

In the future, it is expected that such machines will be operated remotely, without a driver. Even if this scenario comes true, fleet management solutions will remain relevant because they let you make sure that work is going on as it should, from anywhere in the world.

What if Telematics Solutions Disappear?

We end our conversation with R GRUPA on a humorous note and ask what would happen if telematics solutions suddenly disappeared? Krišjānis Caune answers with confidence:

“I would compare it to the apocalypse. We are so used to different technological solutions that telematics is as valuable to us as the internet itself. What would happen if both suddenly disappeared? We would survive, sure – but it would be very difficult”.

If your company also needs a wide range of fleet management solutions, book a consultation with one of Mapon’s Client Project Managers or contact

[email protected]!